This paper utilizes the generalized autoregressive conditional heteroscedasticity–mixed data sampling(GARCH‑MIDAS) approach to predict the daily volatility of state‑level stock returns in the United States (US) from monthly state and national housing price returns. We find that housing price returns generally have a negative effect on state‑level volatility. More importantly, the…

This study investigates the predictability of financial stress (FS) for the volatility of the naira exchange rate amid recent instability, focusing on key foreign currencies like the USD, British pound, and Euro. To achieve the study’s objective, we formulate two distinct models. The first is a single-factor model based solely…

This paper examines the role of climate-related migration uncertainties in forecasting agricultural commodity price volatility, an area largely overlooked in existing research focused on supply shocks. Using a newly developed Climate-related Migration Uncertainty Index (CMUI) and its components – the Climate Uncertainty Index (CUI) and Migration Uncertainty Index (MUI) –…

In this study, we examine the impact of central bank independence on inflation in nondemocratic regimes, with a specific focus on the differences between Islamic and non-Islamic groups. It utilizes non-stationary heterogeneous panels to estimate both the long-run and short-run responses of inflation to central bank independence. Additionally, it employs…

Is the EU’s Carbon Border Adjustment Mechanism Fair to the Global South? With much excitement, we are pleased to share the results of our latest research. In a joint study by the Centre for Econometrics and Applied Research (Ibadan) and the PEP – Partnership for Economic Policy for Economic Policy…

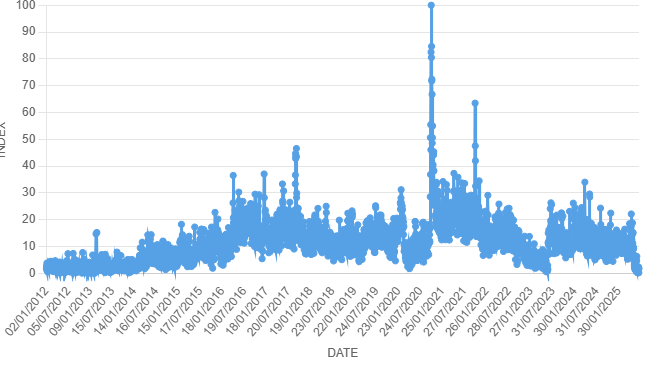

We are delighted to announce that the Geopolitical Risk (GPR) Index for Nigeria has been updated to include data for 2025. The index was developed by one of CEAR’s Fellows, Afees Salisu, in collaboration with his team members, Salisu Subair and Sulaiman Salisu. The authors developed the first geopolitical risk…

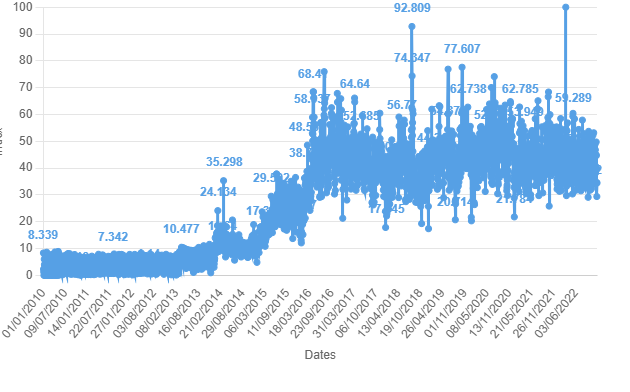

We are pleased to inform you that the Economic Policy Uncertainty (EPU) Index for Nigeria has been updated to include data for 2025. The index was developed by one of CEAR’s Fellows, Afees Salisu, in collaboration with his team members, Salisu Subair, and Sulaiman Salisu Background: The authors developed the…

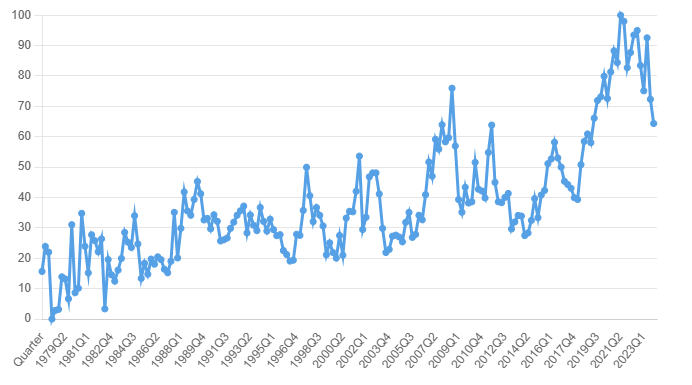

A new index for climate-induced migration uncertainty has been developed by one of our fellows, Afees Salisu, in collaboration with Sulaiman Salisu. The index utilized a range of international newspapers with a global readership. They also developed sub-indices by providing distinct datasets for climate-induced uncertainty and migration-induced uncertainty. Some empirical…

Under the multiple regression lecture, we assume that all the series are stationary at level

(that is, the order of integration of each of the series is zero, I(0))2. If we relax this assumption

and consequently allow for unit roots in the variables, how do we deal with such a scenario?

In general, this would require a different treatment from a conventional regression with

stationary variables at I(0), which has been covered so far.